Tips for Downsizing in Utah’s Competitive Market

Tips for Downsizing in Utah’s Competitive Market

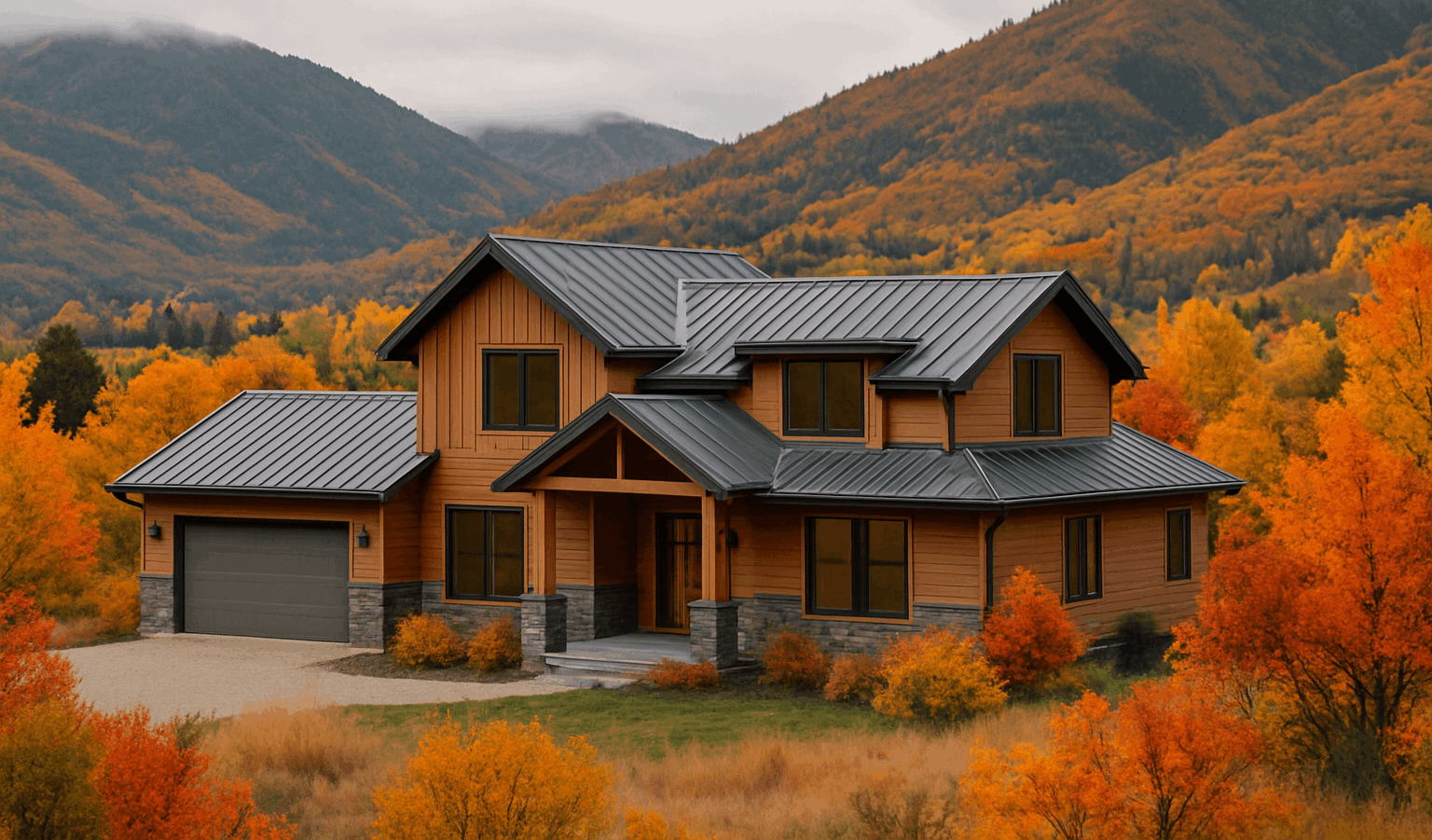

Downsizing—trading a larger home for something smaller and more manageable—has become a growing trend across Utah. Whether driven by empty-nesters seeking less maintenance, retirees looking to cash in on equity, or families wanting to simplify their lifestyles, downsizing can be both liberating and financially rewarding. Yet in Utah’s competitive real estate market, where inventory is tight and desirable smaller homes can move fast, it’s important to approach the process with strategy and preparation. Here are key tips to help make your downsizing journey a success.

1. Define Your “Why” and Your Priorities

Before you begin, clarify why you’re downsizing. Is it to reduce costs, simplify upkeep, move closer to family, or free up equity for travel and lifestyle goals? Understanding your motivation helps shape what kind of property you’ll pursue—whether that’s a low-maintenance townhome in Ogden, a mountain retreat in Eden, or a downtown Salt Lake City condo close to amenities. Make a list of must-haves and deal-breakers, including number of bedrooms, layout preferences, and accessibility features.

2. Get a Realistic Picture of Utah’s Market

Utah’s housing market remains highly competitive, particularly for smaller homes and single-level properties that appeal to downsizers. Locations like the Ogden Valley, Draper, and St. George have seen steady demand for townhomes, patio homes, and smaller single-family houses. Before listing your current home, research comparable prices for the type of property you plan to buy. Partnering with a local real estate agent who knows the nuances of Utah’s micro-markets can help you price, plan, and time your move strategically.

3. Start Decluttering Early

Downsizing means less space, so it’s wise to begin decluttering months in advance. Tackle one area at a time—closets, garage, kitchen, and storage rooms. Ask yourself whether each item adds real value to your life. Donate or sell what you no longer need, and digitize paperwork and photos to minimize storage. Utah has many local donation centers and consignment options, from Habitat for Humanity ReStores to Deseret Industries and boutique resale shops in Ogden and Salt Lake.

4. Consider Future Accessibility

If you’re downsizing for the long term, look for a home that will serve you well for years to come. Single-level living, wide doorways, minimal stairs, and walk-in showers are features that make aging in place easier. Many newer developments in Utah—such as those in Mountain Green or St. George—offer “lock-and-leave” communities with HOA-managed landscaping and maintenance, appealing to retirees and travelers alike.

5. Time Your Sale and Purchase Carefully

One of the biggest challenges in a competitive market is coordinating the sale of your current home with the purchase of your next one. You don’t want to be left without a place to live—or feel rushed into buying. In Utah’s fast-moving market, consider listing your home with a rent-back agreement or securing temporary housing while you shop for your next property. Your agent can also help you explore bridge loans or contingent offers to make the transition smoother.

6. Focus on Lifestyle, Not Just Square Footage

Downsizing isn’t only about smaller space—it’s about right-sizing your lifestyle. Maybe you want to move closer to recreation, community amenities, or family. Utah offers a wide range of lifestyle-focused neighborhoods, from the active outdoor community in Park City to the peaceful mountain setting of Huntsville. Choose an area that enhances your daily life, not just your budget.

7. Evaluate the Financial Benefits

Downsizing can reduce your mortgage payment, property taxes, and utility costs while freeing up home equity for investments or retirement. In Utah, property tax rates vary by county, so consult your agent or financial advisor to understand the long-term cost implications. Also, consider maintenance savings—smaller lawns, fewer rooms, and newer builds can significantly lower upkeep expenses.

8. Be Ready to Act Quickly

Desirable downsized homes—especially those under 2,000 square feet—often receive multiple offers in Utah’s most sought-after areas. Have your financing pre-approved, be flexible with closing terms, and move quickly when you find a home that fits your criteria. An experienced local agent can alert you to new listings the moment they hit the market and help you craft a competitive offer without overpaying.

9. Don’t Overlook Emotional Preparation

Leaving a longtime home can be an emotional process. You’re not just selling a house—you’re closing a chapter filled with memories. Take time to reflect on what you’re gaining: less clutter, more freedom, and a home that fits your current lifestyle. Downsizing can be an empowering step toward a simpler, more intentional way of living.

10. Work With a Local Expert

Every Utah market—from Ogden Valley to Salt Lake to St. George—has its own rhythm, inventory trends, and pricing dynamics. A local real estate professional can help you sell your current home for top value and secure your ideal smaller property efficiently. They’ll also know which communities offer features like snow removal, HOA management, or proximity to healthcare and recreation—key considerations for downsizers.

Final Thoughts

Downsizing in Utah’s competitive market doesn’t have to be stressful. With clear goals, early preparation, and expert guidance, you can make a seamless transition into a home that better fits your lifestyle. Whether you’re moving closer to the mountains, simplifying your daily routine, or freeing up financial flexibility, downsizing offers the opportunity to redefine what home truly means.

Categories

Recent Posts

GET MORE INFORMATION

Agent | License ID: 14225128-SA00