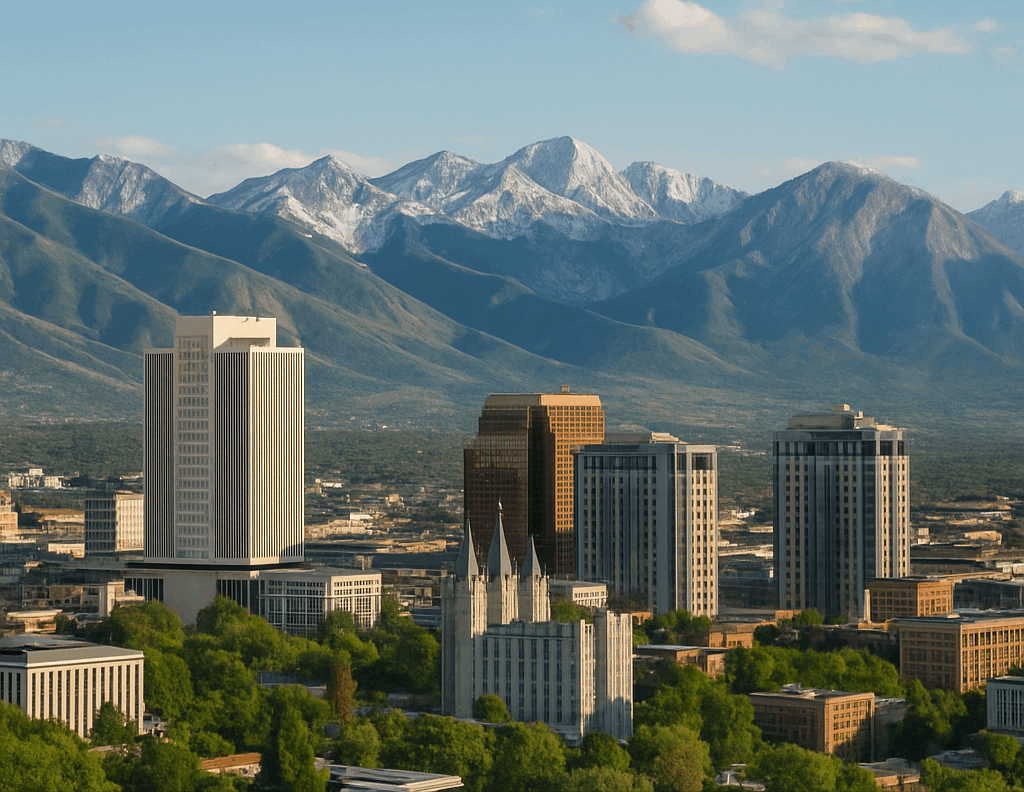

Utah’s Booming Economy: What It Means for Real Estate in 2025

Utah’s Booming Economy: What It Means for Real Estate in 2025

Utah’s economy is no longer just an “up-and-comer”—it has proven itself as one of the strongest and most resilient in the nation. For 18 consecutive years, Utah has ranked at or near the top in economic outlook, job growth, and business climate. This success doesn’t just impact businesses and workers; it directly shapes the housing market. Rising wages, population growth, and strong job creation all fuel demand for homes, rentals, and investment properties across the state.

If you’re buying, selling, or investing in Utah real estate, understanding how the economy performs is critical. Let’s take a closer look at where Utah ranks, why its economy is thriving, and what it all means for real estate in 2025.

Key Economic Rankings and Indicators

GDP and Growth

Utah’s Gross State Product (GSP) surpassed $300 billion for the first time in 2024, placing it around 28th among U.S. states. While Utah doesn’t match the sheer scale of California or Texas, what makes it stand out is growth rate. In 2024, Utah posted 4.6% GDP growth, leading the nation and more than doubling the U.S. average.

This growth isn’t concentrated in a single industry—it’s spread across technology (the “Silicon Slopes” corridor from Salt Lake City to Provo), manufacturing, outdoor recreation, tourism, and financial services. For real estate, this diverse foundation is key. When a state isn’t overly reliant on one industry, its housing market tends to be more stable during downturns.

Employment and Jobs

Employment is one of the clearest indicators of how healthy an economy—and by extension, a housing market—is. Utah shines here as well. By mid-2025, nonfarm payroll employment had grown 2.3% year over year, compared to about 1% nationally. The state has added tens of thousands of jobs across sectors including tech, construction, healthcare, and financial services.

Unemployment is consistently low, hovering between 3.1% and 3.2% in 2025. This not only signals economic strength but also creates confidence among homebuyers. People are far more likely to purchase a home when jobs are abundant and secure. For sellers, strong employment means more qualified buyers in the market.

In real estate investment terms, job growth also supports the rental market. As more workers relocate to Utah—whether for Silicon Slopes tech jobs or outdoor lifestyle opportunities—demand for rental housing increases, keeping vacancy rates low and rents stable or rising.

Income and Affordability

Utah’s per capita personal income reached $66,400 in 2025, a figure that’s competitive with the national average and steadily rising. Strong wage growth gives residents more purchasing power, fueling demand for homes even as prices rise.

However, rapid income growth combined with population increases creates affordability challenges. Salt Lake City, Ogden, and Provo have all seen double-digit home price increases in recent years. While this benefits current homeowners looking to sell, buyers are navigating tighter budgets, higher interest rates, and more competition.

For investors, this dynamic can be attractive. Higher incomes and a young, growing population mean strong rental demand, while rising home prices provide long-term appreciation potential. For buyers, it underscores the importance of timing and strategy—getting into the market sooner often means securing better long-term equity.

National Rankings

Utah’s economic reputation is well established. The ALEC-Laffer Economic Competitiveness Index has ranked Utah #1 for economic outlook 18 years in a row. This is largely due to low taxes, pro-business policies, and a growing labor force.

Other national rankings echo the same message:

-

WalletHub’s “Best & Worst State Economies” consistently places Utah near the top for growth and innovation.

-

U.S. News & World Report ranks Utah high in economy, infrastructure, and quality of life.

-

Forbes and CNBC frequently highlight Utah as one of the best states for business and careers.

These rankings matter for real estate because they signal stability and long-term demand. Buyers and investors know Utah isn’t just riding a short-term boom—it’s structurally set up for continued growth.

Why Utah’s Economy Matters for Real Estate

1. Population Growth Fuels Housing Demand

Utah is one of the fastest-growing states in the nation. Families, retirees, and young professionals are moving here for jobs, affordability (relative to coastal states), and quality of life. This steady stream of new residents puts pressure on housing supply, driving up both home values and rental rates.

In hot spots like Salt Lake City, Ogden, and the Ogden Valley, population growth means sellers benefit from multiple-offer situations, while investors see strong long-term returns.

2. Job Creation Drives Stability

Job creation is the foundation of a healthy housing market. Utah’s consistently strong employment growth means fewer foreclosures, steadier appreciation, and more confidence among buyers. When people feel secure in their jobs, they’re more likely to buy homes, refinance, or move up into larger properties.

For investors, steady job growth ensures the rental market remains tight, especially in college towns and tech hubs.

3. Rising Incomes Support Home Values

As incomes rise, so does purchasing power. This has allowed Utah’s housing market to remain strong even during periods of higher mortgage rates. Sellers benefit from buyers with more financial flexibility, while investors can count on reliable rent payments in markets with higher average wages.

4. Affordability Challenges Create Market Tension

The downside of rapid growth is affordability. Median home prices in Utah have climbed sharply, and while incomes are rising, they don’t always keep pace with housing costs. This creates opportunities for creative solutions such as ADUs (Accessory Dwelling Units), multi-family housing, and townhome developments, all of which are gaining popularity in places like Ogden and Salt Lake City.

For buyers, affordability challenges may push them toward up-and-coming areas like North Ogden, Roy, or West Haven—places where growth is spilling over from larger metros.

The Bottom Line: Utah Real Estate and the Economy

Utah’s economy ranks among the best in the nation, and its strengths—diverse industries, strong job creation, rising incomes, and population growth—directly translate to real estate opportunity. Sellers enjoy higher demand and price stability, while buyers and investors benefit from long-term growth prospects, even as affordability challenges make the market more competitive.

If you’re looking at Utah real estate in 2025, know this: the state’s booming economy isn’t just good news for businesses—it’s shaping the housing market in ways that will continue to matter for years to come.

Categories

Recent Posts

GET MORE INFORMATION

Agent | License ID: 14225128-SA00