Utah Closing Costs for Buyers and Sellers Explained

Utah Closing Costs for Buyers and Sellers Explained

When buying or selling a home in Utah, many people focus on the sales price, the down payment, or the mortgage details. However, closing costs are a major part of the transaction that often catch buyers and sellers off guard. Understanding Utah closing costs—what they are, who pays for them, and how much they typically run—can help you plan ahead and avoid last-minute surprises.

What Are Closing Costs?

Closing costs are the collection of fees, taxes, and charges that are due when the property officially changes hands. These are separate from the down payment and usually include expenses like loan origination fees, title insurance, recording fees, and escrow services. In Utah, closing costs vary based on whether you are the buyer or seller, the price of the home, and the type of loan used.

Closing Costs for Buyers in Utah

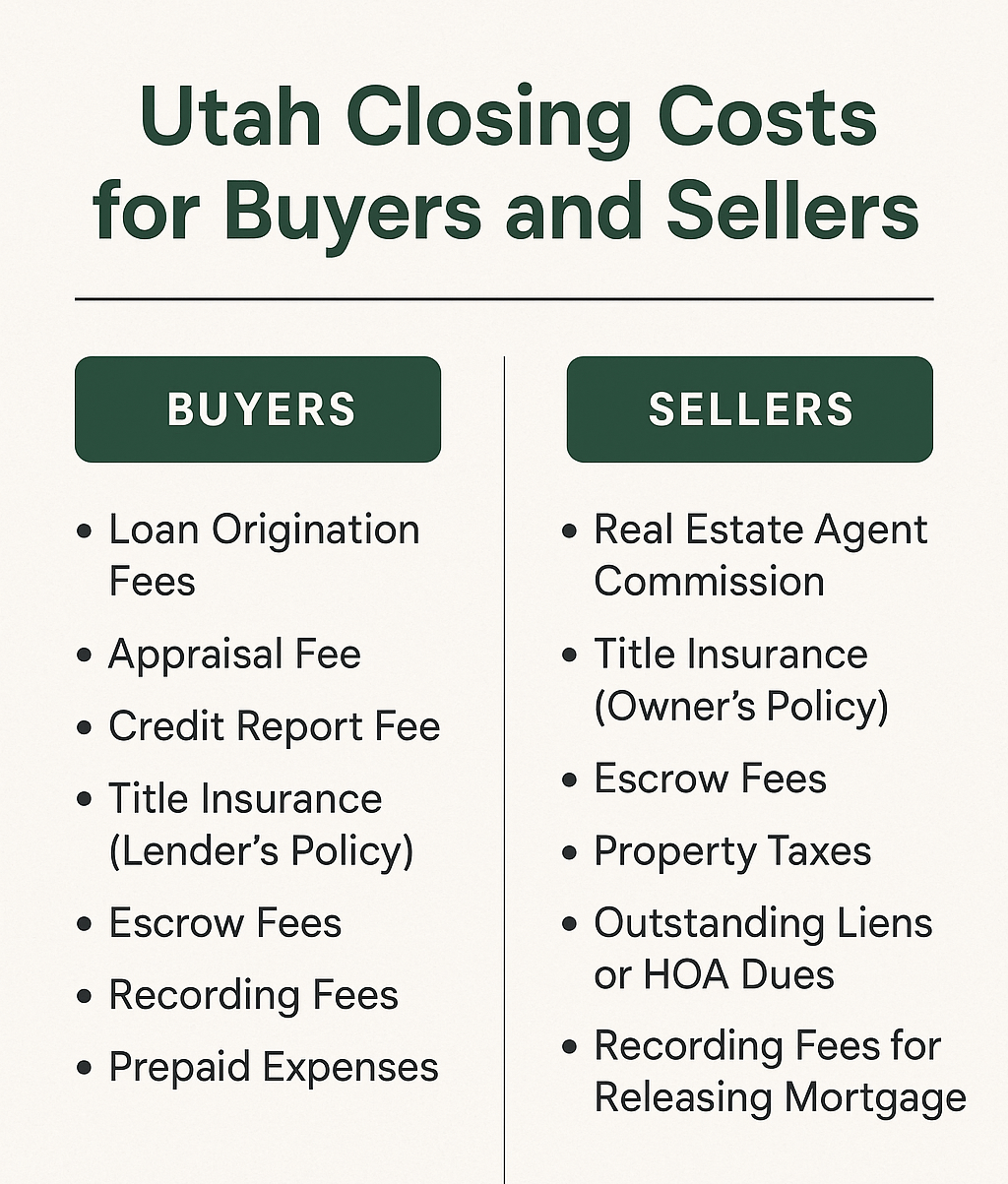

Buyers in Utah should expect to pay between 2% and 5% of the purchase price in closing costs, though the final number depends on lender requirements and negotiated terms. Common buyer costs include:

-

Loan origination fees: Charged by the lender to process and underwrite the loan.

-

Appraisal fee: A professional assessment of the property’s value, often required by lenders.

-

Credit report fee: A small charge to pull the buyer’s credit score.

-

Title insurance (lender’s policy): Protects the lender against claims on the property.

-

Escrow fees: Charged by the escrow or title company for handling funds and documents.

-

Recording fees: Paid to the county to officially record the sale.

-

Prepaid expenses: Such as homeowners insurance, property taxes, and mortgage interest.

Some of these costs can be negotiated with the seller through closing cost credits, which is more common in a buyer’s market.

Closing Costs for Sellers in Utah

Sellers also have closing costs, though they are structured differently. The biggest cost for Utah sellers is the real estate agent commission, which usually ranges from 5% to 6% of the sale price and is split between the buyer’s and seller’s agents. Other typical seller costs include:

-

Title insurance (owner’s policy): Protects the new buyer from past claims on the property.

-

Escrow fees: Split between buyer and seller in most transactions.

-

Property taxes: Sellers are responsible for their share of property taxes up until the closing date.

-

Outstanding liens or HOA dues: Any unpaid amounts must be settled before closing.

-

Recording fees for releasing the mortgage: If the seller has an existing mortgage, the lien release must be recorded with the county.

On average, sellers in Utah can expect their non-commission closing costs to range between 1% and 3% of the sale price.

Who Pays Closing Costs in Utah?

In Utah, there isn’t a one-size-fits-all rule for who pays what. Traditionally:

-

Buyers pay lender-related fees, appraisal, inspections, and the lender’s title insurance policy.

-

Sellers pay real estate commissions, the owner’s title insurance policy, and their prorated share of taxes.

-

Escrow fees are typically split evenly, though this can vary by county and negotiation.

Tips for Managing Closing Costs

-

Shop around for lenders and title companies. Fees can vary significantly.

-

Ask for a loan estimate early. This gives you a breakdown of expected charges.

-

Negotiate with the other party. Sellers sometimes offer credits toward buyer closing costs as an incentive.

-

Budget ahead. Set aside funds beyond your down payment to cover these expenses.

Final Thoughts

Closing costs in Utah can add up, whether you’re buying or selling a home. For buyers, it’s usually 2%–5% of the purchase price, while sellers should anticipate paying commissions plus 1%–3% in additional fees. Understanding these expenses ahead of time will make your real estate transaction smoother and prevent financial surprises at the closing table.

If you’re preparing to buy or sell a home in Utah, working with an experienced local real estate agent and a trusted lender can help you estimate your specific costs more accurately.

Categories

Recent Posts

GET MORE INFORMATION

Agent | License ID: 14225128-SA00