Best Utah Cities for Flipping Houses in 2025

Best Utah Cities for Flipping Houses in 2025

If you're looking to flip houses in Utah in 2025, you're standing at a promising crossroads. The state's booming economy, population growth, and vibrant real estate markets are fueling opportunities for savvy investors. Here are the top Utah cities to watch this year:

Salt Lake City

The capital remains a powerhouse in Utah's real estate landscape. Salt Lake City is projected to be the hottest real estate market in the Western U.S. in 2025, ranking 10th nationally. Its strong job market, influx of new residents, and low housing inventory create high demand—perfect conditions for flipping. The city's growth in tech, healthcare, and finance fosters consistent appreciation, and its appeal as a cultural hub ensures liquidity for renovated properties.

Ogden

Ogden stands out for its combination of affordability and growth. It topped Milken Institute’s list of best-performing U.S. cities in 2025, alongside Salt Lake City. Projected median home prices in Ogden are around $500,000 with 8% year-over-year growth. Ogden also offers strong rental yields, with a rent-to-price ratio of 4.7%. Its diverse economy—bolstered by healthcare, education, and the presence of Hill Air Force Base—makes it a stable market for flips.

Provo

With Brigham Young University at its core, Provo has stellar demand for rentals and flips alike. The median home price hovers around $478,000, while rental occupancy stands at an impressive 94%. Economic expansion, a growing tech startup scene, and low vacancy rates make Provo ideal for investors eyeing high turnover and strong ROI.

Saratoga Springs and Lehi

If rapid appreciation is your focus, look no further. Saratoga Springs and Lehi have posted some of the highest growth rates in Utah. Saratoga Springs has seen median sale prices rise nearly 16%, while Lehi has experienced over 14% growth. Lehi is part of the booming Silicon Slopes corridor and benefits from rapid development and tech job growth.

St. George

Though farther afield, St. George is gaining attention for its strong rental yields, warm climate, tourism appeal, and ongoing new-home construction. Annual rental yields are about 4.5%, making it an attractive flip-and-rent destination. Its lifestyle appeal ensures strong buyer interest year-round.

Heber City, Midway, and Kamas

The luxury market near Park City has soared. While Park City’s average home is incredibly expensive, often exceeding $2 million, nearby towns like Heber City, Midway, and Kamas are offering more affordable options and appealing alternatives for buyers fleeing Park City’s sticker shock. Flippers here can tap into luxury demand at a lower entry cost.

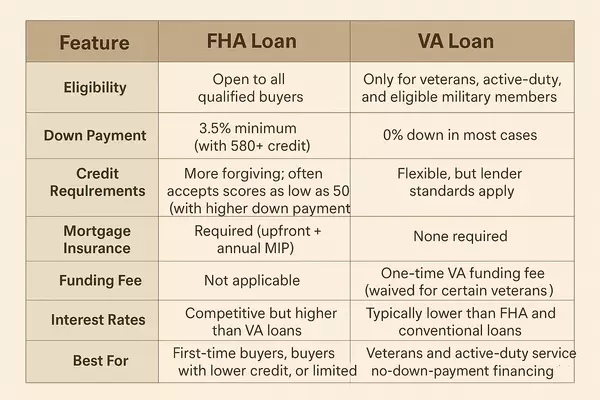

Summary: Top Utah Cities for House Flips in 2025

| City/Region | Key Advantage |

|---|---|

| Salt Lake City | Highest demand + scarcity = strong appreciation |

| Ogden | Affordable with high rental yields and job stability |

| Provo | Student demand + tech economy = low vacancy, fast flips |

| Saratoga Springs & Lehi | Exceptional appreciation rates |

| St. George | Tourism-driven rentals + high yield |

| Heber City, Midway, Kamas | Luxury-adjacent, high upside with lower cost |

Tips for Flippers in Utah’s 2025 Market

-

Apply the “70% Rule”: Ensure you're purchasing at no more than 70% of the after-repair value, minus renovation costs.

-

Focus on NOI & Cash Flow: Target areas where post-renovation projections show positive operating income after costs.

-

Consider Growth & Infrastructure: Cities like Lehi and Ogden benefit from infrastructure investment and employment expansion.

-

Account for Inventory Scarcity: In hot markets like Salt Lake City, competition is fierce—smart sourcing and quick rehab are key.

-

Stay Local-Savvy: Neighborhood nuances can make or break margins—research schools, development plans, and zoning changes.

Whether your strategy is rapid flips in hot tech corridors like Lehi or steady appreciation in stable markets like Ogden and Provo—or even tapping into luxury spillover near Park City—Utah offers robust opportunities for house flippers in 2025. Stay data-driven, watch the trends, and act fast.

Let me know if you'd like a deeper dive into any city or financing strategies to pair with your flipping plans!

Categories

Recent Posts

GET MORE INFORMATION

Agent | License ID: 14225128-SA00